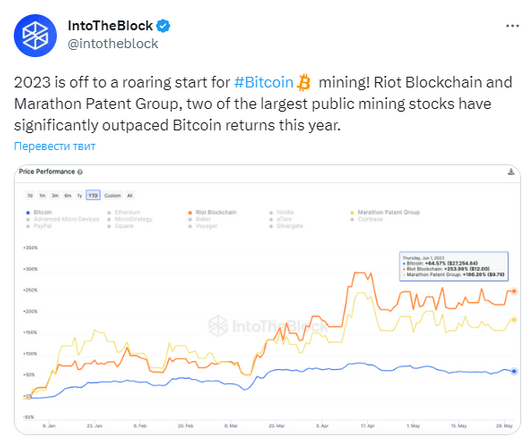

It is possible that Bitcoin (BTC) miners have survived a challenging period characterised by tighter regulatory measures, growing concerns about the negative impact on the environment and simply a decline in the exchange rate of the main cryptocurrency. However, there are signs that this dark period is coming to an end, and shares of some mining companies are showing signs of recovery. According to information from IntoTheBlock, shares of Marathon Patent Group and Riot Blockchain have outperformed BTC since the beginning of the year.

The year 2023 promises a storming start for Bitcoin mining! Riot Blockchain and Marathon Patent Group, two of the largest public mining companies, have significantly outperformed Bitcoin’s revenue this year.

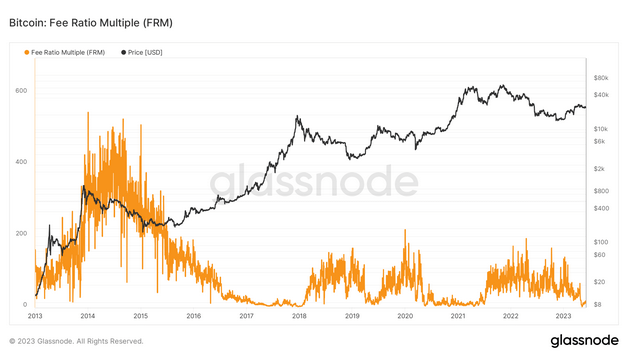

K 1. In June, Bitcoin’s productivity increased by 64.57%, Riot’s stock saw a 258.98% increase, while Marathon’s stock value rose by 186.26%. One of the reasons for this turnaround has been the increase in revenue and fees that miners have seen recently due to the emergence of transaction fees on the Bitcoin network. Interestingly, data from Glassnode showed that the fee multiplier dropped to 19.78. Calculated as a ratio of total revenue to transaction fees, this multiplier serves as a measure of the security of the blockchain when blocks disappear.

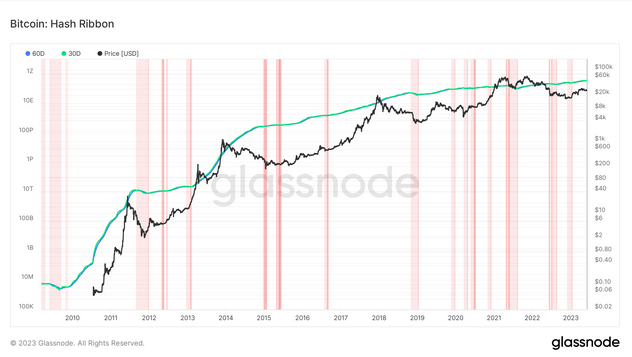

Because Bitcoin’s FRM (Fee Ratio Multiple) was low, this suggests that the asset could maintain its budget for security through miners‘ income without being dependent on inflationary subsidies. Conversely, if the FRM were high, miners would need block reward subsidies to maintain revenues. However, hash rate indicators suggest that the worst is over for miners, but some problems still remain. This metric uses a 30-day moving average (MA) to measure the capitulation of miners and the ability to purchase their capacity.

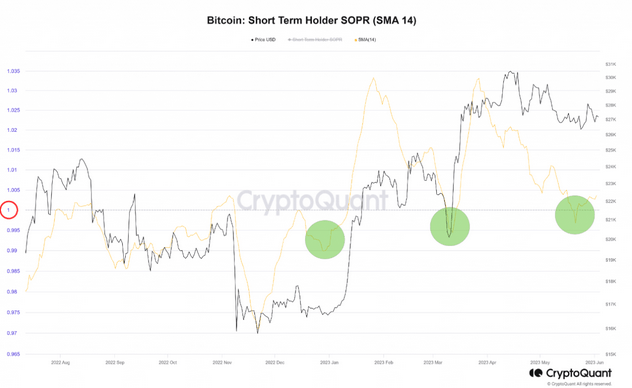

This indicator also suggested that bitcoin offered a good buying opportunity. This occurred as the hash rate entered the white zone, indicating a change in price momentum from positive to negative. According to an article by CryptoQuant published on Crazzyblockk, the balanced Spent Output Profit Ratio (SOPR) confirms the above conclusion.